��- Ersin Merdan holds��an MSc in Eurasian Political Economy & Energy��from King’s College London and��also an��MA in European Studies from Sabancı University.

With a rapid decline in oil prices following 2014, Russia’s financial footing further deteriorated and federal budget revenues from oil and gas plummeted from 50 percent in 2014 to 36 percent in 2016. As hydrocarbon revenues dwindled, Russia began to consider that diversification away from more mature and stagnant Western energy markets towards Asian markets is a necessity to generate and secure more revenues from hydrocarbon sales. Russia’s plan to expand its natural gas market share with neighboring countries, particularly with China, coincided well with China’s urgent need for reducing its heavy dependence on coal. By switching to natural gas, China aimed at both reversing its rapidly deteriorating air quality and diversifying its energy supply sources. Yet this mutual dependency has not turned into a profitable energy deal for Russia as expected resulting in a glut of import options for China.����

Over the past decade, China’s overall energy demand doubled and outstripped domestic production. The need for energy imports grew to the extent that to fuel industrial expansion, diversification of energy sources and suppliers became a priority for Chinese policymakers for a sustainable economic growth path. With such a priority, Chinese decision makers started to seek alternative suppliers not only for energy security reasons but also for better energy deals. Furthermore, China’s security concerns over its reliance on sea-lanes for oil and gas imports has put Russia’s vast oil and gas resources under the spotlight.

Unlike oil and coal, natural gas has been playing a minor role in China’s overall energy mix for many years, accounting approximately for 6 percent of its total energy mix in 2016. However, the desire to burn more environmentally-friendly fuel to generate electricity and for household heating, has seen China’s natural gas demand grow at a rapid pace since 2008, increasing by an average of 14 percent from 2010 to 2015. China has chosen to switch to natural gas over coal whose consumption has been rising to produce twice as much energy in China, but yet the share of natural gas consumption in the energy mix still remains relatively small.

Notwithstanding, Russia’s vast oil and gas reserves came under scrutiny as an alternative source of hydrocarbons for China’s expanding economy. Both countries, although willing to go along with any beneficial deals, encounter economic and political difficulties in pipeline exports and also face competition from newly emerging hydrocarbon-rich countries.����

Although Russian Gazprom, Novatek Rosneft are eager to expand their market share in Asia, they have to confront the reality that the Chinese gas market has already been well supplied with pipeline gas from Turkmenistan and from LNG from Australia, Malaysia, Australia as well as Indonesia. Therefore, the growing importance of Central Asian gas, the imminent arrival of U.S. and Australian LNG, the emergence of potential production of local shale gas, the decline in economic growth along with the slower demand growth rate have all worked against the wishes of Russia in expanding its Asian market.

With a growing interest in diversifying its natural gas, China has developed a network of suppliers across Central Asia. This network stretches from Uzbekistan to Kazakhstan and onto Turkmenistan. Starting from Turkmenistan’s Galkynysh field, the Central Asia-China pipeline’s contract was signed in 2013 to carry 30 billion cubic meters () of Turkmen gas to Chinese gas market making Turkmenistan the largest provider by far of natural gas to the Chinese gas market.

The Central Asian states were highly reliant on Russia because of the old gas pipeline infrastructure constructed during the Soviet era.�� However, over-reliance on Russia is becoming less important for exports to China’s west, since China is working meticulously to construct the necessary infrastructure for its needs. Consequently, Central Asian countries have become a major competitor to piped Russian gas for China’s gas imports. Furthermore, to export piped gas to China as and when needed, China is supporting Central Asian countries with project financing, the necessary equipment and with manpower to develop the necessary infrastructure.

With this strategy, China is eager to have a major influence over the region’s hydrocarbons. Large-scale investment projects in the region have already a challenge to Russia’s supremacy in piped gas exports to Asia.��

Another front over which Russian gas producers have to compete for the Chinese gas market is the increasing availability of LNG worldwide. As massive LNG power plants come online, natural gas prices globally have experienced a rapid decline. While China had 54 of regasification capacity in 2014, it is expected by the end of this decade this capacity will reach 90 . Currently, 48 percent of natural gas used in China comes from LNG, supplied by countries varying from Australia, Qatar, Malaysia, Indonesia, and some African states.

In recent years, China has gained a strong bargaining position serving the country’s interests well in ensuring that it obtains the best possible prices in the market. Against this background, it is unsurprising that any major natural gas export deal between China and Russia has been fraught with difficulties, amid the various alternatives with protracted and complex negotiations arising to secure the best deal.

China exploits every opportunity and uses its position as a power hungry consumer to extract the best commercial deal even for a project where China has an equity interest, such as the Power of Siberia pipeline. With an export capacity of 38 stretching over 3,000 kilometers, the Power of Siberia was signed in 2014 to provide Russian gas to China starting from 2019. The 30-year agreement could be seen as Russia’s successful shift away from the EU market. However, during the negotiation of the project, China set Russian counterparties against each other to secure the optimal deal at a price well below the global average.

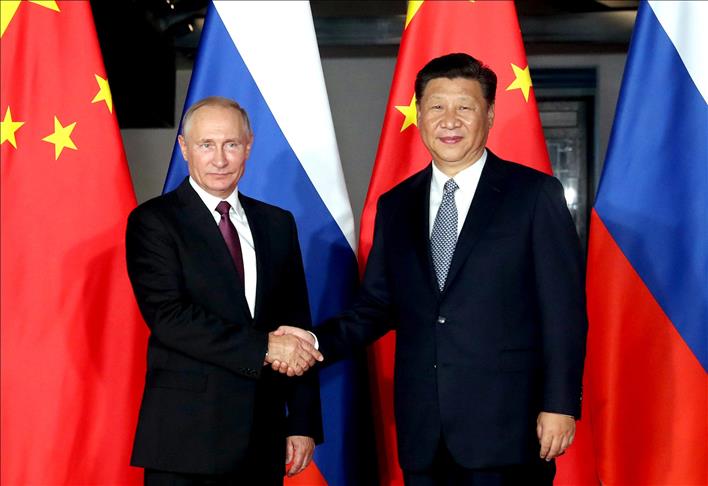

In the wake of the Ukrainian crises since March 2014, the imposition of western sanctions on Russia paved the way for the proposal of a round of wide-ranging Sino-Russian natural gas cooperation deals. However, while Sino-Russian relations have inevitability been brought closer to conclude deals, while mutual energy dependency has clearly motivated greater trade, the result of gas sales to China has not been as successful as expected.

Even though there is potential for further Russian gas exports to the Chinese gas market, the fact that China has an oversupply of import options, with many LNG providers and piped gas from Central Asia, China has acquired greater bargaining clout amid the many alternatives. With many options on the table, Chinese policymakers are well aware of the fact that they can sit tight as soon as the country has a need for extra volumes of gas. Since Russia is unable to take control and steer this market to its liking, China’s dominant role in determining natural gas pricing and volumes is likely to remain for the foreseeable future.

- Opinions expressed in this piece are the author’s own and do not necessarily reflect Anadolu Agency's editorial policy.